Mark Phillips - January, 1st 2024

Gold gains big but is Silver being suppressed?

As we move forward in time, let’s recap how gold did in 2023. Even with a bit of a drop in December, gold ended up with a strong 10% gain for the year. It’s not really a surprise when we looked at inflation data and the devaluation of the U.S. dollar in recent years. With all the ups and downs in the economy and changes in the money world, gold has been like a rock, keeping its value and attracting people who want something steady to invest in. In this post, we'll look at what made gold do so well this year, considering all the different things happening around the world that affect its price.

And let’s not forget Silver. Silver's story is a bit more complicated and there's a lot of talk about why its price might not be as high as it could be. Some people think big players in the market are keeping the price down on purpose. We'll check out these ideas, like how big deals in the silver market or actions by important banks might affect silver's price. We're also going to investigate something called "paper silver" and how that could make silver seem more common than it actually is. Plus, there have been times when companies got in trouble for messing with the prices of precious metals and while for legal reasons, we aren’t going to name names, just google some big bank names with the words “silver, sec and lawsuit” in it. We'll explore all these thoughts and theories to give you a full picture of what's going on with silver, especially when we compare it to how well gold has done. So, let's get started and uncover the 2023 story behind our two favorite metals!

Why did Gold have so much momentum this year?

Gold's impressive 13% gain in 2023 can be attributed to several key factors, three of which stand out prominently. Firstly, inflation played a significant role. As prices for goods and services rose, investors turned to gold as a hedge against the diminishing purchasing power of money. Gold is traditionally seen as a safe store of value during inflationary periods, and this year was no exception. Secondly, the devaluation of the U.S. dollar had a substantial impact. Gold is often inversely related to the dollar's strength; as the dollar weakened against other currencies, gold became more attractive to investors holding other currencies, thus driving up its demand and price. Lastly, global geopolitical tensions added to gold's allure. Amid uncertainties and instability in various parts of the world, gold's reputation as a safe haven during times of crisis further bolstered its appeal, encouraging more investors to turn to this precious metal as a secure investment option. These factors combined to bolster gold's status in 2023, making it a standout year for this enduring asset.

And while the gold haters and hedge fund guys will continue to hate, everyone in the industry and precious metals investors see none of this as a surprise and only fortifies our position in this safe haven asset.

Purchasing Power of the U.S. Dollar Over Time

Credit: The Visual capitalist

Silver, a fail safe for banks and corporate America

In 2023, the silver market presented a unique scenario, closing the year with a marginal decline of half a percent. This subtle yet notable downtrend in silver prices can be viewed through the lens of several theories that suggest underlying forces at play in the market. One significant theory revolves around large short positions in futures markets. It's speculated that major financial institutions and traders might have placed substantial short bets on silver, anticipating a decline in its price. Such strategic moves, if prevalent, could exert downward pressure on silver prices, as these large positions can significantly influence market perception and trading behavior.

Another perspective to consider is the role of paper silver and the influence of central bank policies. The availability of paper silver - financial instruments representing silver, like futures and options, but not backed by physical silver - creates an illusion of oversupply. This perceived abundance can dampen investor enthusiasm for actual physical silver, suppressing its price. Additionally, central bank policies, particularly those related to currency valuation and interest rates, can indirectly impact silver prices. As silver is often seen as a hedge against currency devaluation and inflation, any policy that strengthens the currency or curtails inflation can reduce silver's appeal as a safe-haven asset, even if these policies are bogus or the stats are pushed dishonestly by certain media outlets. Together, these factors contribute to a complex tapestry that might explain the marginal decrease in silver prices over the year, showcasing the multifaceted nature of commodity market dynamics.

Image shows the front steps of the Central Bank

5 prominent theories about silver price suppression

Certainly, the belief that the price of silver is being suppressed is a topic often discussed among some investors and market analysts. Here are five reasons often cited by those who believe in silver price suppression:

- Large Short Positions in Futures Markets: Some believe that large financial institutions or traders take massive short positions in silver futures markets. By doing so, they can potentially manipulate the price downward, which would be beneficial for their short positions. This can also happen when trade desks place large buy and sell orders, only to cancel them. Plenty of SEC lawsuits have happened in the past due to this which makes this less of a theory and more of a, ‘when will the next one be?’

- Central Bank Policies: It's speculated that central banks may have an interest in keeping silver prices low. Silver, like gold, is often seen as a hedge against inflation and currency devaluation. If the price of silver rises significantly, it could be interpreted as a lack of confidence in fiat currencies, potentially undermining central bank policies.

- Silver Lease Rates and Paper Silver: The use of paper silver (silver futures, options, and other financial instruments that represent silver but are not backed by physical silver) and low silver lease rates can influence the perceived abundance and value of silver, potentially leading to price suppression by creating the illusion that a large over supply exists, when it in fact does not.

- Price Smoothing Operations: Some believe that certain entities engage in price smoothing operations, where large sell orders are placed at key moments to prevent the price of silver from rising too rapidly. This could be done to maintain market stability or for other strategic reasons. Plenty of SEC lawsuits here as well!

- Regulatory Oversight and Market Manipulation Concerns: There have been instances in the past where financial institutions were fined for manipulating precious metal markets. This leads some to believe that similar activities could be ongoing in the silver market, escaping adequate regulatory scrutiny or enforcement.

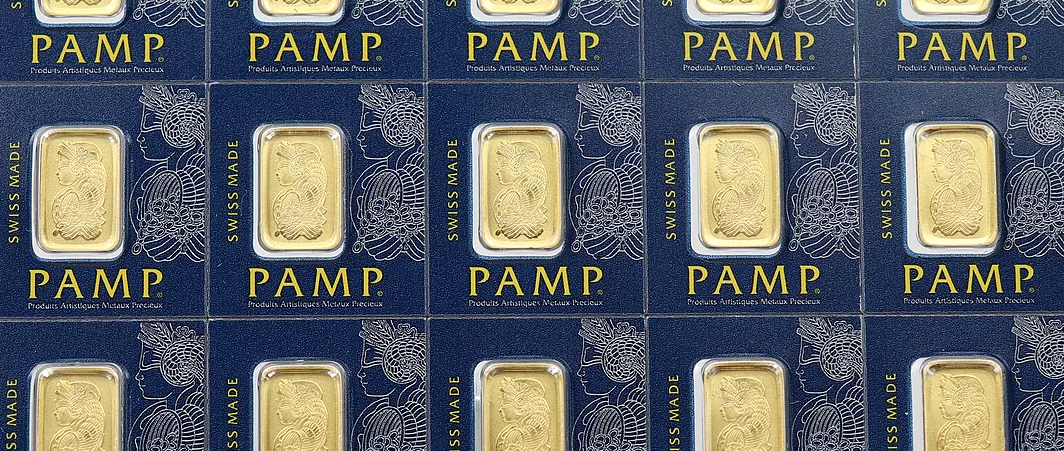

Secure your investments!

Regulatory Oversight and Market Manipulation Concerns: There have been instances in the past where financial institutions were fined for manipulating precious metal markets. This leads some to believe that similar activities could be ongoing in the silver market, escaping adequate regulatory scrutiny or enforcement.

It's important to note that these are speculative reasons and not universally accepted as fact. The precious metals market, like any financial market, is complex and influenced by a wide range of factors, including economic indicators, supply and demand dynamics, and investor sentiment. This is NOT financial advice and should not be taken as such.

As always guys, thanks for stopping by and from Investor Crate to your family, Happy New Years and keep on stackin’!

This is in no way to be considered investment advice. Past performance is no guarantee of future results. Asset allocation and diversification do not ensure a profit or guarantee against a loss. Keep in mind that any form of investing involves risk and you should always consult with your financial advisor before making any financial decisions. Investor Crate, LLC., it's subsidiaries and staff will never advise you on any asset as our aim is to provide a fun and affordable service should you decide to purchase Precious Metals.

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Time to be buying silver !

Silver is rarer than gold so shouldn’t it be worth more than gold?

I will always buy silver! I would love some gold, also, but not in my budget currently.

Pleasantly Surprising , and Most Advantageous to Say the Least , Thank You Investor Crate ! ! !

A long term investment that only goes up !